We return to the Cyberattack That Changed Everything, wondering how much and to whom UnitedHealth paid ransom–now that they’ve finally admitted it. Also returning to those Merger Guidelines and how they may change the face of healthcare M&A. VA and DOD hard at work on their EHRs and systems, Lumeris gains a luminous funding, but Optum staff are seeing pink slips.

(Shifting Alerts to this Thursday, Friday, Saturday)

Two studies: Telehealth underutilized, underbilled, even during pandemic–and accounted for only modest increases in costs, and quality (Perhaps undercaptured?)

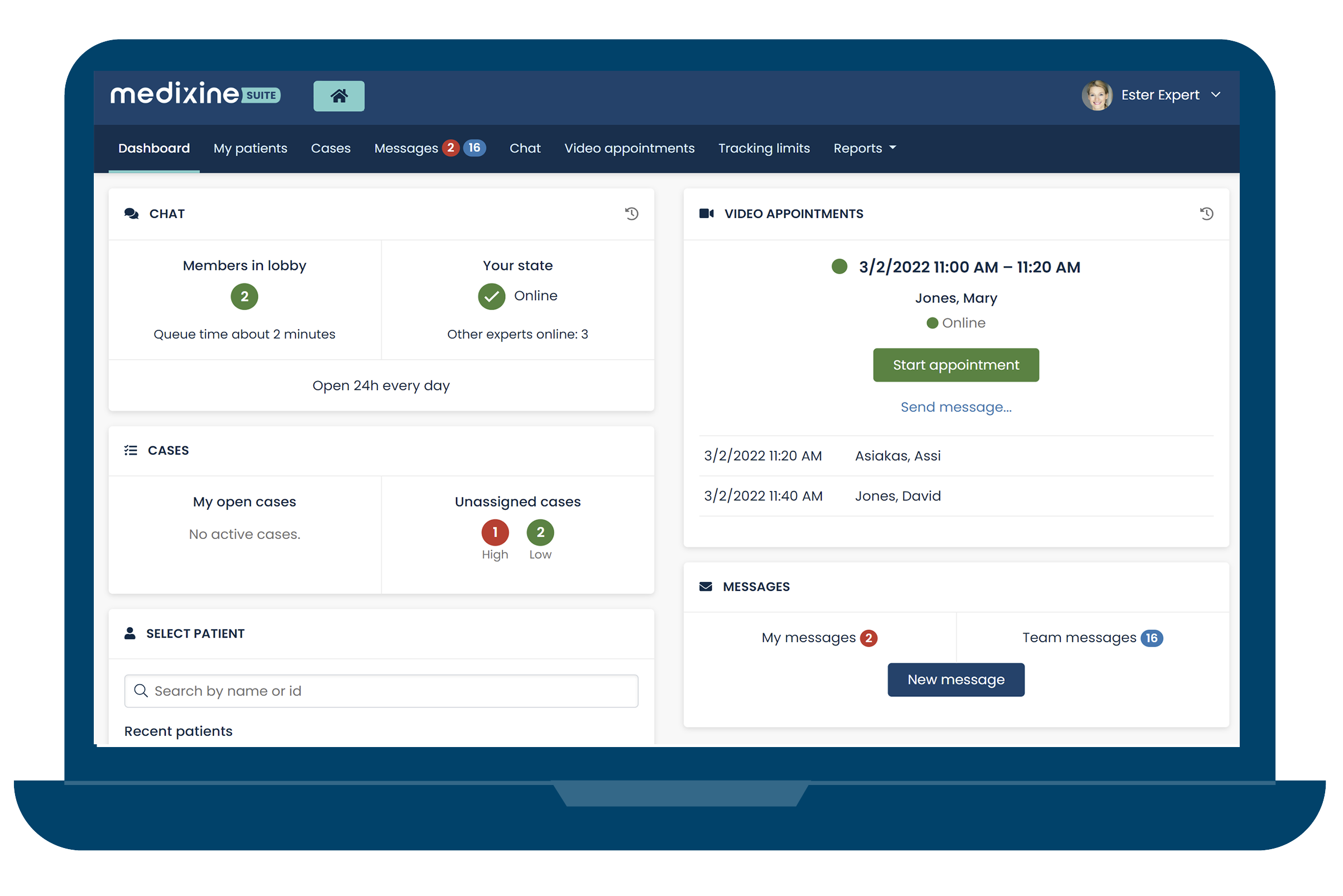

Short takes: VA seeks vendor to support EHR testing; Defense Health seeks ‘digital front door’ vendor; GAO recommendations to Oracle; Nonin partners with Finland’s Medixine; Lumeris gains $100M equity funding

What the DOJ and FTC Merger Guidelines mean for healthcare M&A–a Epstein Becker Green podcast (Legal department torture)

Breaking: UnitedHealth admits to paying ransomwareistes on Change stolen patient data (updated) (For what and how much?)

Who really has the 4TB of Change Healthcare data 4 sale? And in great timing, Optum lays off a rumored 20K–say wot? (UHG has some ‘splainin’)

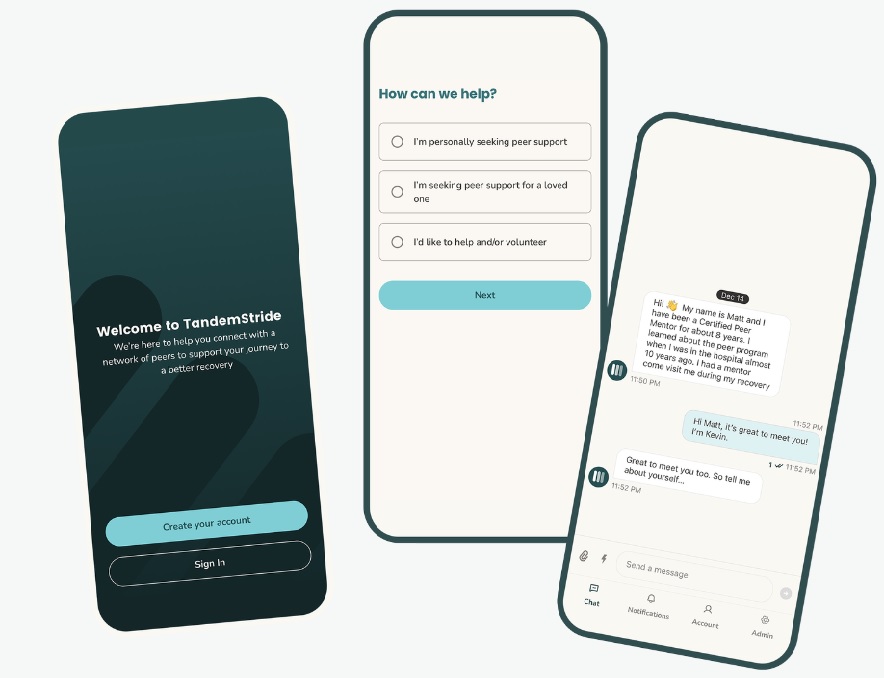

Another packed week, with a few baffling events. Leading in bafflement is NeueHealth’s additional $30M from NEA, which now owns 60%. UHG battling on multiple fronts between the Change hacking and the House, Walgreens lays off more to cut costs, VillageMD sued on ad trackers, and Cerebral’s comeuppance costs $7.1M. VA may restart Oracle Cerner implementation, Epic and Particle Health feud. But restoring faith in health tech benefiting a neglected group is TandemStride.

TandemStride launches platform to assist survivors of traumatic injury; a personal look (A real care gap)

News roundup: Congress hammers absent UHG on Change cyberattack–and more; 10% unhinged at Hinge Health; Steward Health nears insolvency; Two Chairs $72M Series C (UHG’s troubles cover the waterfront)

ISfTeH student contest and award 2024–deadline 26 April! (Move fast!)

Mid-week short takes: UnitedHealth’s $1.2B Q1 loss from Change attack, another Walgreens layoff, Dexcom-MD Revolution partner, Kontakt.io $47.5 raise, GeBBS Healthcare may sell for $1B (Walgreens still downsizing–what’s next)

News roundup: VillageMD sued on Meta Pixel trackers; Cerebral pays $7.1M FTC fine on data sharing, cancellation policy; VA may resume Oracle Cerner implementation during FY2025; Epic-Particle Health dispute on PHI sharing (Cerebral still in trouble)

The New Reality, Bizarro World version: NeueHealth gets $30M loan increase from NEA, now majority owner (Baffling)

This packed week was about righting listing ships. Teladoc’s CEO suddenly departs, Amwell at risk of a NYSE delisting–we look at What Happened and what needs to be done. VillageMD gets new COO to manage the shrinkage. And Change Healthcare data on sale from disgruntled ALPHV affiliate. Digital health funding continues to limp along. Clover looks at another delisting, Walmart Health applies the brakes. And we highlight innovations from Novosound, Biolinq, Eko, Universal Brain.

Digital health’s Q1 according to Rock Health: the New Reality is a flat spin back to 2019 (Limping, but alive)

VillageMD names new president and COO as it shrinks to 620 locations (Ex Centene, Humana exec comes out of short retirement to clean up)

News roundup: Now Clover Health faces delisting; BlackCat/ALPHV affiliate with 4TB of data puts it up for sale; $58M for Biolinq’s ‘smallest blood glucose biosensor’ (Will UHG pay more ransom?)

Opinion: Further thoughts on Teladoc, Amwell, and the future of telehealth–what happens next? (A hard look at the follies, mistakes, and saving ships)

News roundup: Amwell faces NYSE delisting; Walmart Health slows Health Centers, except Texas; Novosound’s ultrasound patent; Eko’s Low EF AI; Universal Brain; Elizabeth Holmes in ‘Dropout’ + update

Teladoc CEO Jason Gorevic steps down immediately in shock announcement (Now what?)

A damp start to April leads with puzzling news. NeueHealth loses plans and big money in ’23–but gives a big bonus to its CEO. Cano Health reorganizing or selling by June. ATA kicks DOJ about expediting controlled substance telehealth regs. Apple keeps kicking around the ‘Davids’, but Davids won’t stop slinging either. And if you work with a PR or marketing agency, our Perspectives has some advice for you.

More New Reality: NeueHealth (Bright Health) CEO’s $1.9M bonus, 2023 financials–and does Cano Health have a future? (Two stories gone way sideways)

ATA requests expediting of revised proposed rule on controlled substance telehealth prescribing; announces Nexus 2024 meeting 5-7 May (DEA needs to get moving now, not later)

Davids (AliveCor, Masimo) v. Goliath (Apple): the patent infringement game *not* over; Masimo’s messy proxy fight with Politan (updated) (Seeing value in Masimo?)

Perspectives: Working with a PR Agency–How to Make the Most of the Partnership (Expert advice if you manage communications)

It was a pre-Easter week that started as quiet and got VERY LOUD at the end. Walgreens took the hard road, writing down VillageMD even before the closures were final and lowering forecasts. An important metastudy+ casts doubt on the efficacy of present digital health diabetes solutions but provides solid direction forward. And it’s definitely an early sunny spring for funding, but there’s continued bad weather forecast for UnitedHealth Group and Oracle Cerner’s VA implementation.

Facing Future 2: Walgreens writes down $5.8B for VillageMD in Q2, lowers 2024 earnings on ‘challenging’ retail outlook (Biting bullet early and hard)

Short takes: PocketHealth, Brightside fundings; VA OIG reports hit Oracle Cerner; Change cyberattack/legal updates; UHG-Amedisys reviewed in Oregon; Optum to buy Steward Health practices (UHG carries on as does company funding)

Can digital health RPM achieve meaningful change with type 2 diabetics? New metastudy expresses doubt. (Major digital health findings from PHTI)

This week’s Big Quake was DOJ’s antitrust suit against Apple for smartphone monopoly and control over apps. Another quake: 2023 data breaches were up 187%–when a medical record is worth $60, it’s logical. Early-stage funding and partnerships are back with a roar when AI’s in your portfolio. And Walgreens shrinks both VillageMD and distribution.

2023 US data breaches topped 171M records, up 187% versus 2022: Protenus Breach Barometer (And that was LAST year!)

Why is the US DOJ filing an antitrust lawsuit against Apple–on monopolizing the smartphone market? (One wonders)

Mid-week roundup: UK startup Anima gains $12M, Hippocratic AI $53M, Assort Health $3.5M; Abridge partners with NVIDIA; VillageMD sells 11 Rhode Island clinics; $60 for that medical record on the dark web (Funding’s back and AI’s got it)

Walgreens’ latest cuts affect 646 at Florida, Connecticut distribution centers (More in next week’s financial call)

Have a job to fill? Seeking a position? See jobs listed with our new job search partner Jooble in the right sidebar!

Read Telehealth and Telecare Aware: https://telecareaware.com/ @telecareaware

Follow our pages on LinkedIn and on Facebook

We thank our advertisers and supporters: Legrand, UK Telehealthcare, ATA, The King’s Fund, DHACA, HIMSS, MedStartr, and Parks Associates.

Reach international leaders in health tech by advertising your company or event/conference in TTA–contact Donna for more information on how we help and who we reach.

Telehealth & Telecare Aware: covering the news on latest developments in telecare, telehealth, telemedicine, and health tech, worldwide–thoughtfully and from the view of fellow professionals

Thanks for asking for update emails. Please tell your colleagues about this news service and, if you have relevant information to share with the rest of the world, please let me know.

Donna Cusano, Editor In Chief

donna.cusano@telecareaware.com

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

Most Recent Comments