Optum Virtual Care closing, staff layoffs in progress. Optum Everycare CEO Jennifer Phalen on an 18 April internal conference call announced that the unit would close. According to sources, some employees would have layoff dates in July. No further details were available on other layoffs or plans for integrating Virtual Care’s capabilities into other Optum units, except for generalities. “We are committed to providing patients with a robust network of providers for virtual urgent, primary and specialty care options,” and “We continually review the capabilities and services we offer to meet the growing and evolving needs of our businesses and the people we serve.” a spokesperson for UnitedHealth said to Endpoints, a biopharma publication from the University of Kansas which broke the story.

Optum Virtual Care closing, staff layoffs in progress. Optum Everycare CEO Jennifer Phalen on an 18 April internal conference call announced that the unit would close. According to sources, some employees would have layoff dates in July. No further details were available on other layoffs or plans for integrating Virtual Care’s capabilities into other Optum units, except for generalities. “We are committed to providing patients with a robust network of providers for virtual urgent, primary and specialty care options,” and “We continually review the capabilities and services we offer to meet the growing and evolving needs of our businesses and the people we serve.” a spokesperson for UnitedHealth said to Endpoints, a biopharma publication from the University of Kansas which broke the story.

For Optum, this is the second shoe drop about layoffs and closures in less than two weeks. Reports from social media and layoff-specific boards indicated that thousands were being laid off, from their plans to urgent care and providers [TTA 23 Apr]. These were not confirmed by Optum nor by UnitedHealth Group. It’s not known if this unit’s closure was included in the total.

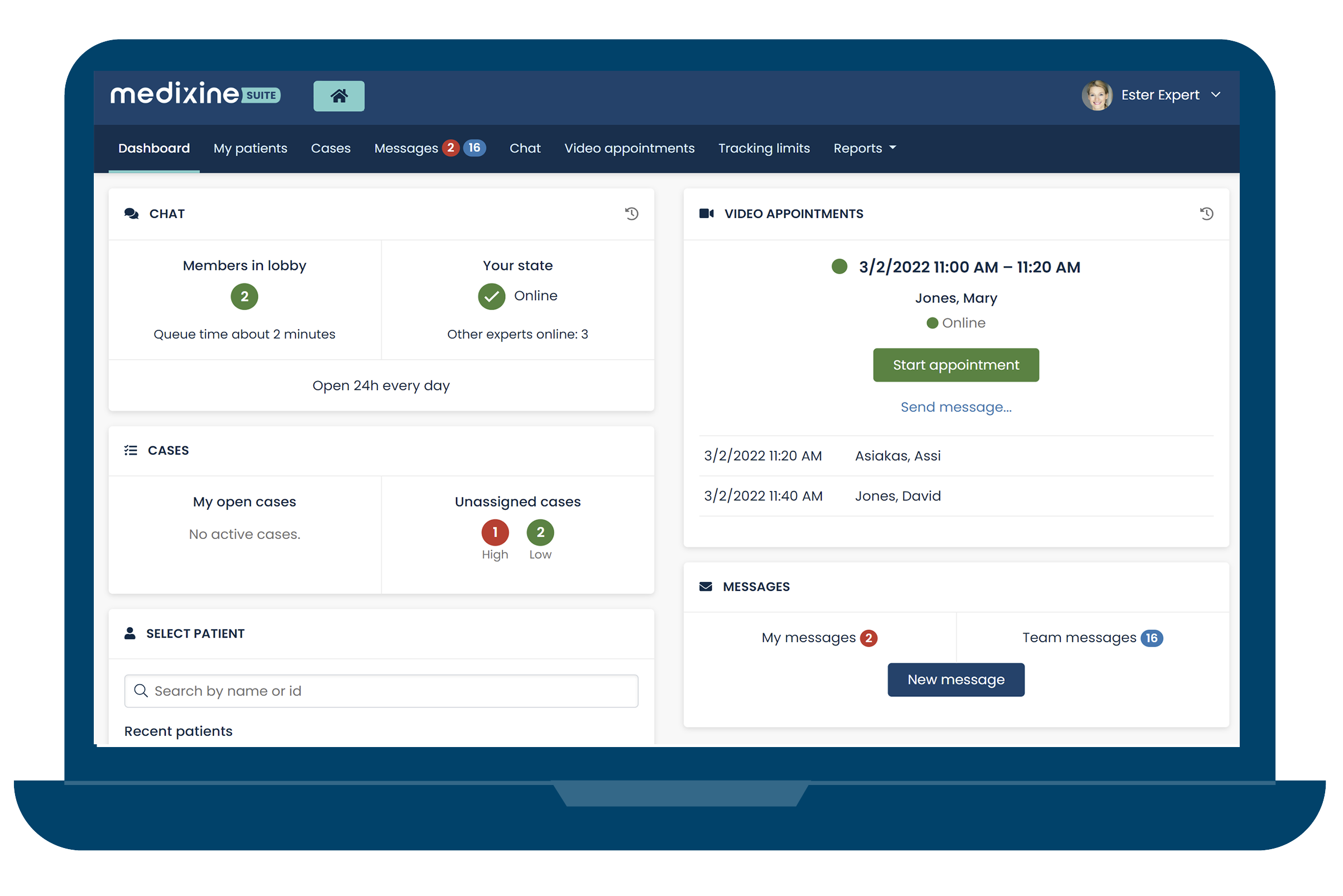

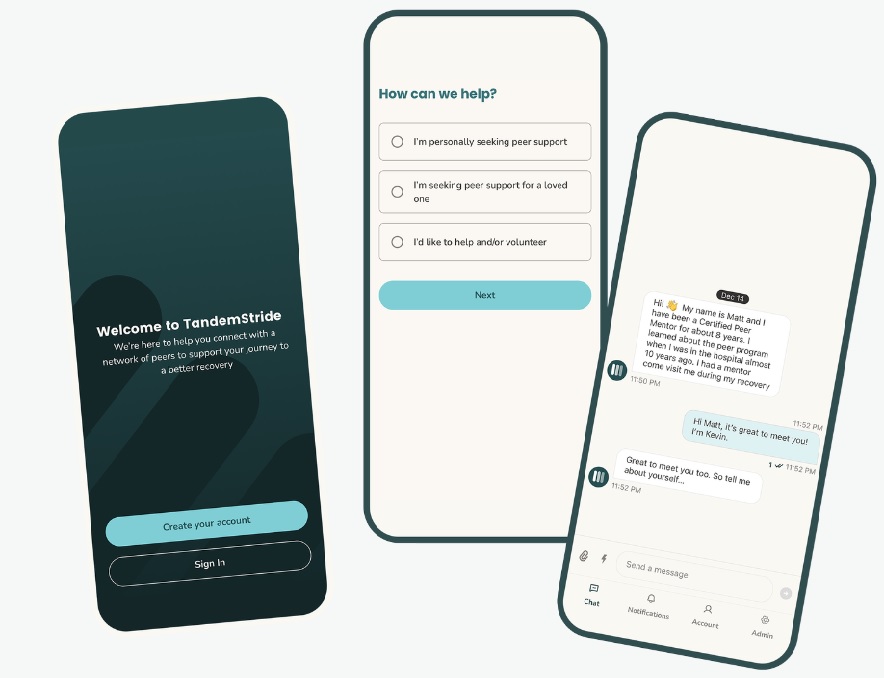

The larger picture is that it is symptomatic of the sudden growth, then equally sudden consolidation, of general telehealth. Optum opened the unit in April 2021 as the pandemic entered year 2. Utilizing existing capabilities, UHG claimed it facilitated more than 33 million telehealth visits in 2020, up from 1.2 million in 2019. The number looks sky high but in that time of practices closing it was a free-for-all in telehealth–and ‘facilitating’ is a nebulous catchword that could mean a practice using Facetime, telephones, or an EHR/population health platform module. Commercial claims for telehealth have remained at 4 to 5% since (FAIR Health, Jan 2024). Even during the pandemic’s first year, telehealth claims hit a peak of 13 percent in April 2020 that dropped fast to 6% by August 2020. Well over 60% are for behavioral telehealth claims.

A leading indicator: Last June, Optum Everycare’s CEO from their 2021 start, Kristi Henderson, a former Optum SVP for digital transformation, departed to become CEO of Confluent Health, a national network of occupational and physical therapy clinics. It was about as far away as one could get from telehealth, digital transformation, and her former employer, Amazon Care, that expired in 2022.

Apparently, UHG and Optum see no further need for a virtual care specialty unit, instead integrating it into plans and other Optum services. According to MedCityNews, industry analysts aren’t surprised. Both Amwell and Teladoc have had well-known struggles. The latest: Walmart, after investing millions into their unit that included full clinics and a virtual care service, also made news on 30 April that it is closing both. Also greatly on UHG’s mind: cleanup after the Change debacle, making Mr. Market happy, and the looming antitrust action by DOJ. Becker’s, Healthcare IT News,

In another sign that investors are selling off ancillary businesses, Advocate Health is selling PERS provider MobileHelp. It “no longer fit the strategic priorities of Advocate Health” according to their 22 April audit report (see document pages 10 and 13) and was authorized last December.

Advocate, through its investment arm Advocate Aurora Enterprises, acquired both MobileHelp, one of the earliest mobile PERS, and sister company Clear Arch Health, a remote patient monitoring provider, in April 2022. Cost was not disclosed at that time but later was reported to be $290.7 million. The plan at the time was to combine both MobileHelp and Clear Arch with a senior care/home health provider earlier acquired by Advocate for $187 million, Senior Helpers. That company was sold in March to Chicago-based private equity firm Waud Capital Partners for an undisclosed amount. The MobileHelp sale is expected to close later this year. Buyer and price are not disclosed. The expected loss on the MobileHelp sale was figured into FY 2023 as part of an asset impairment write-down of $150 million, which Advocate said was “related to the expected loss on the sale of MobileHelp.” Milwaukee Business Journal, Becker’s, Crain’s Chicago Business (requires subscription)

VA admits that some veterans may be affected by Change Healthcare data breach, PII/PHI disclosure. While Department of Veterans Affairs Secretary Denis McDonough at this time believes that “there’s no confirmation yet” that veteran data was exposed, the scope of the Change Healthcare breach has led VA to formally alert via email 15 million veterans and their families of the possibility. The email also included information “about the two years of free credit monitoring and identity theft protection” that Change Healthcare is offering to those affected by the attack. The VA maintains that the attack resulted in only a temporary delay in filling 40,000 prescriptions but did not cause “any adverse impact on patient care or outcomes,” according to a department spokesman. NextGov/FCW 26 April, 23 April

In related news, HHS as of 19 April had not received any notification from Change Healthcare nor UHG. They are required to file a breach report as providers and also as covered entities. They have 60 days from the breach occurrence on 21 February to report, which is coming right up. Becker’s

If Larry said it, it must be true…assemble the moving boxes. At an Oracle conference in Nashville last week, Oracle chairman Larry Ellison said to Bill Frist of investment firm Frist Cressey Ventures that he planned to move the company to that city as “It’s the center of the industry we’re most concerned about, which is the healthcare industry.” It’s their second public Larry and Billy meetup in the last few months, the last in November at the Frist Cressey Ventures Forum where Ellison had previously touted Nashville. Ellison is investing in and building a 70-acre, $1.35 billion campus on Nashville’s riverfront. Oracle is currently HQ’d in Austin, Texas having moved in 2020 from Redwood City, California but with extensive facilities remaining in the area. Texas and Tennessee have one thing in common–a superior business climate. Both are long on lifestyle, though Austin is not as temperate as Nashville. What Nashville has that Austin doesn’t is being a healthcare hub. At least in Ellison’s view, healthcare is where it’s at and so is Nashville. So as long as he’s active at Oracle, Oracle does what Larry says. Healthcare Dive, Healthcare IT News, The Tennessean

Most Recent Comments