GE Healthcare now trading on its own. On Wednesday, GEHC rang Nasdaq’s traditional opening bell virtually on its first day of trading Wednesday (4 Jan). The bell ringing was unique as the first company in Wisconsin to do so from their plant in Waukesha. GE retained approximately 19.9% of the outstanding shares of GE HealthCare common stock with the remaining 80.1% distributed to current GE shareholders. Today it closed at $58.95 and remains headquartered in Chicago. (It moved from Amersham UK back in 2016.) Management is now independent, with Peter Arduini as CEO and adding yesterday a new chief technology officer, Taha Kass-Hout MD, MS, from Amazon’s health AI area to lead the company’s new science and technology organization through their four areas: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics. Release, Yahoo Finance Also Mobihealthnews

GE Healthcare now trading on its own. On Wednesday, GEHC rang Nasdaq’s traditional opening bell virtually on its first day of trading Wednesday (4 Jan). The bell ringing was unique as the first company in Wisconsin to do so from their plant in Waukesha. GE retained approximately 19.9% of the outstanding shares of GE HealthCare common stock with the remaining 80.1% distributed to current GE shareholders. Today it closed at $58.95 and remains headquartered in Chicago. (It moved from Amersham UK back in 2016.) Management is now independent, with Peter Arduini as CEO and adding yesterday a new chief technology officer, Taha Kass-Hout MD, MS, from Amazon’s health AI area to lead the company’s new science and technology organization through their four areas: Imaging, Ultrasound, Patient Care Solutions, and Pharmaceutical Diagnostics. Release, Yahoo Finance Also Mobihealthnews

Remember back in 2019 when problematic EHR Practice Fusion was renamed Veradigm? Allscripts has now renamed the entire company as Veradigm, after expanding it to analytics and research. After two years of reorganizing and downsizing (plus paying off Practice Fusion fines), selling off their hospital/large practice EHRs to Constellation Software/N. Harris Group for $700 million last May, the slimmed-down Veradigm Network encompasses electronic health records, practice management systems, and patient communication platforms. Interestingly, a search first leads you to a main corporate website under Allscripts and doesn’t forward automatically to Veradigm, making this a softer-than-usual name change. Now Veradigm can pick up a few companies on the market, as they announced last year. Release Hat tip to HISTalk

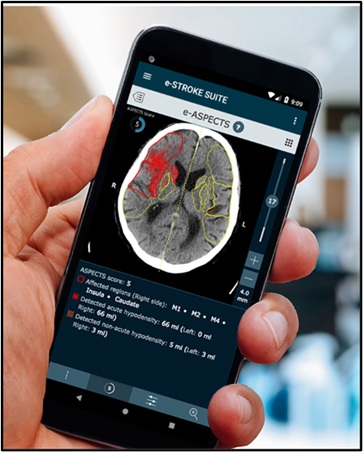

NHS using Brainomix AI to diagnose stroke faster, tripled near-full recoveries to 48%. The key finding: patients diagnosed using AI made near full recoveries increased from 16 to 48%. The trial of e-Stroke Suite took place in 22 hospital trusts in England across 111,000 suspected stroke patients. The AI in the e-Stroke Suite cut average diagnosis to treatment time by an hour from 140 to 79 minutes. The AI technology was developed by UK company Brainomix. Daily Mail, Oxford Academic Health Science Network case study (Note: Oxford AHSN, Brainomix, and Royal Berkshire NHS Foundation Trust (RBH) are partners in the National Consortium of Intelligent Medical Imaging (NCIMI).)

NHS using Brainomix AI to diagnose stroke faster, tripled near-full recoveries to 48%. The key finding: patients diagnosed using AI made near full recoveries increased from 16 to 48%. The trial of e-Stroke Suite took place in 22 hospital trusts in England across 111,000 suspected stroke patients. The AI in the e-Stroke Suite cut average diagnosis to treatment time by an hour from 140 to 79 minutes. The AI technology was developed by UK company Brainomix. Daily Mail, Oxford Academic Health Science Network case study (Note: Oxford AHSN, Brainomix, and Royal Berkshire NHS Foundation Trust (RBH) are partners in the National Consortium of Intelligent Medical Imaging (NCIMI).)

Withings is debuting the U-Scan, an in-home urinalysis device, at CES. The 90 mm device sits in the toilet bowl and uses cartridges to analyze urine components, sending results to the Withings Health Mate app. Cartridges for Europe so far are Cycle Sync for menstrual period tracking and ovulation windows, and Nutri Balance for hydration and nutrition. Nutri Balance analyzes specific gravity, pH, vitamin C, and ketone levels. The U-Scan will debut in Europe at the end of Q2, with the U-Scan starter kit priced at €499.95. Both await FDA clearance. Withings U-Scan page, Mobihealthnews

Careficient buys Net Health’s home health/hospice EMR. Careficient already is present in the home health, hospice and home care cloud EMR market. Net Health is selling its home health, hospice, home care and palliative solutions EMR, marketed under HealthWyse and Hospicesoft, as well as its revenue cycle management (RCM) division, to concentrate on wound care and rehabilitation therapy. This expands Careficient’s client base by 750 locations in 39 states. Transaction cost was not disclosed. Release

Add to the cost of hacking multiple class action lawsuits. CommonSpirit Health, based in Chicago and the second largest health system in the US covering 21 states under CHI and Dignity Health names, not only has to remedy a massive 600,000 patient data breach discovered last October [TTA 3 Dec], but also fight a class action lawsuit filed 29 December by a patient in the US District Court for the Northern District of Illinois. Financial, health insurance, and medical information were all breached. The suit requests damages exceeding $5 million and injunctive relief, including stronger data protection practices. It will be the first of many as a quick search indicates multiple law firms seeking claimants. FierceHealthcare, WGNRadio

Most Recent Comments