Hospitals and health systems in 2020 and 2021 were desperate for virtual solutions. But comes the reckoning now that they have returned to 1) business as (mostly) usual and 2) even more financial shortfalls. Technology and software contracts typically run three to five years, with new vendor contracts usually three or four. Did these solutions work as implemented? Probably on a spectrum of very well to ‘kinda’. But did they return the desired results in care quality, financially on investment or simply add to the fixed costs which aren’t affordable anymore?

Panda Health, a company that consults with hospitals on digital health adoption, did research via Sage Growth Partners in March 2023 surveying 100 hospital C-suite executives and leaders to assess whether they were satisfied with their current digital health solutions acquired in the pandemic period, whether they would renew with the same vendors, or search for new vendors. While this survey size is small and hedged, the directional prediction is that there will be considerable churn–turnover–among vendors in 2023-25, but not in every one of the 11 areas surveyed have the same risk.

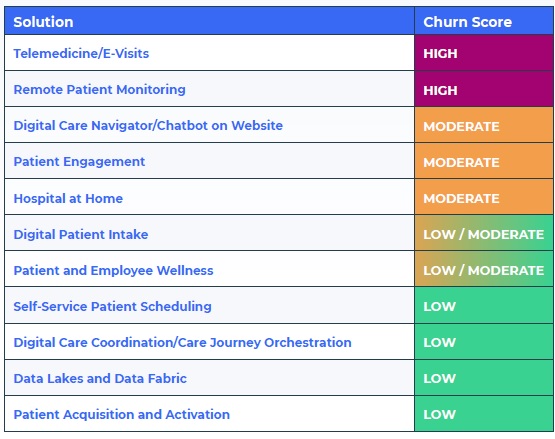

Not unexpectedly, the highest churn risk is projected to be among telemedicine/e-visits and remote patient monitoring (RPM)–the two areas most kickstarted by the pandemic. Lower risk was found in functional areas such as self-service patient scheduling, digital care coordination, patient acquisition/activation, and IT areas such as data lakes and data fabric. Five categories are in the middle.

Telemedicine/E-Visits: 97% of surveyed health executives stated that the pandemic crisis played a role in their acquisition decision. 47% were ‘moderately’ to ‘not satisfied’ with their choices. 30% of these contracts will expire this year and next. In projecting this against a US total of 6,414 hospitals, 1,693 may be changing solutions by the end of 2024.

Remote Patient Monitoring: The pandemic kickstarted RPM adoption by hospitals. 82% of hospitals deployed their solutions since the pandemic began with 19% within the past 12 months. 53% reported that they were ‘moderately’ to ‘not satisfied’ with their choices. With 33% of contracts expiring by 2024, the study estimates that 1,058 hospitals may be changing their solutions.

A different picture–Digital Care Navigator/Website Chatbot: Only 14% of respondents adopted these solutions, all within the past two years. Only 25% of contracts come due during 2024, with 55% coming due in 2025 and the remainder presumably in 2026 and beyond. Yet of all 11 categories, 63% of executives reported some level of dissatisfaction, with 38% ‘not satisfied’–the highest percentage in the study. 197 hospitals are projected to consider changing solutions by the end of 2024.

Even low/moderate and low churn solution categories have moderate (‘moderately’ to ‘not satisfied’) levels of dissatisfaction that edge close to 50%. Exceptions are the last two categories, Data Lakes and Patient Acquisition. Fair warning to all companies who are selling digital health into hospitals–it’s time for your customer success teams to get busy, find out where their pain points are, and who’s feeling them.

The Great Shakeup (free report, PDF download). Panda release. Hat tip to HIStalk 14 June

Most Recent Comments