Forward, a primary care provider that works on a membership model and has practices in 14 markets, announced a line extension to their existing practices. CarePods are self-serve closed kiosks designed for placement in malls, offices, and gyms that deploy a variety of AI-powered health apps for disease detection, biometric body scans, blood testing in disease areas, including diabetes, hypertension, weight management, and mental health (depression and anxiety). The CarePods will be deployed in the San Francisco Bay Area, New York, Chicago, and Philadelphia. Access to CarePods and the app starts at $99/month and $1,639/year–the release is not clear on whether that can include in-office visits. It is not covered by insurance, including Medicare or Medicaid.

Forward, a primary care provider that works on a membership model and has practices in 14 markets, announced a line extension to their existing practices. CarePods are self-serve closed kiosks designed for placement in malls, offices, and gyms that deploy a variety of AI-powered health apps for disease detection, biometric body scans, blood testing in disease areas, including diabetes, hypertension, weight management, and mental health (depression and anxiety). The CarePods will be deployed in the San Francisco Bay Area, New York, Chicago, and Philadelphia. Access to CarePods and the app starts at $99/month and $1,639/year–the release is not clear on whether that can include in-office visits. It is not covered by insurance, including Medicare or Medicaid.

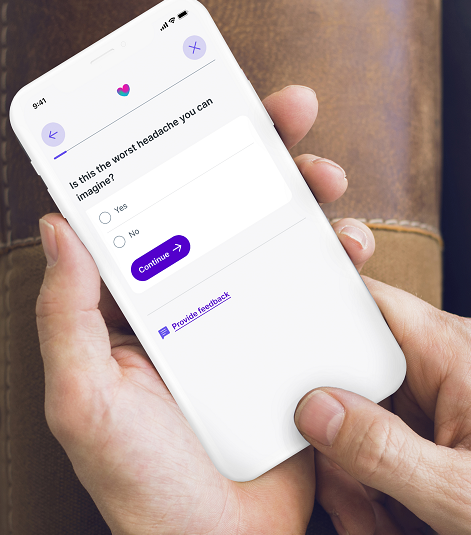

The technology is an extension of what’s seen in their offices (this NY-based Editor is bombarded with YouTube ads for membership) that uses body scanning, vital signs monitoring, blood testing, heart monitoring, and corresponding apps for preventative care and condition management. While the ads feature human doctors and clinicians, the impression from the ads and website is that the health exams are technology-driven and while there are clinicians, they may not necessarily be there. It is not for getting updated on your vaccinations or diagnosing a rash or fever. Forward claims 100+ primary clinicians at 19 locations.

The technology is an extension of what’s seen in their offices (this NY-based Editor is bombarded with YouTube ads for membership) that uses body scanning, vital signs monitoring, blood testing, heart monitoring, and corresponding apps for preventative care and condition management. While the ads feature human doctors and clinicians, the impression from the ads and website is that the health exams are technology-driven and while there are clinicians, they may not necessarily be there. It is not for getting updated on your vaccinations or diagnosing a rash or fever. Forward claims 100+ primary clinicians at 19 locations.

Forward raised a $100 million Series E to deploy the CarePods from Khosla Ventures, Founders Fund, Samsung Next, Abu Dhabi Investment Authority, and Softbank. It consists of equity financing of more than $50 million as well as debt financing. Forward’s total financing is $657 million with its Series D round (Crunchbase). Forward also boasts a blue chip roster of advisers from Eric Schmidt of Google to Robert Wachter, MD.

In viewing this first from their communications representatives, this Editor was immediately reminded of the last time she saw a closed type of health kiosk. I demo’d HealthSpot Station at the CES preview in NYC in late 2012. It officially debuted at CES 2013. Despite decent takeup, HealthSpot was defunct by mid-2016 having placed only 50 or so stations and burned through a substantial $43 million through its entire short but showy life. Its remains went to now-bankrupt Rite Aid which did nothing reportable with it. HealthSpot had key differences with Forward’s CarePods in that HealthSpot was a place to sit down and have a synchronous virtual visit with a doctor (supplied by Teladoc initially), with vital signs monitoring through self-serve tools in the kiosk. Payment was per use and for the doctor visit. Their problems were placement of rather large units, maintenance, and the general reluctance of people to use monitoring tools at that time within a closed area. Based on the available media, the CarePod technology is much more advanced towards a virtual visit with touch screens, AI assists, sophisticated monitors, and an integrated app that generates care plans. It also builds on an established app and in-office technology. Concerns remain in this Editor’s view about maintenance, especially with the CarePod using much more sophisticated technology, cleanliness, and claustrophobia. FierceHealthcare, PYMNTS

In viewing this first from their communications representatives, this Editor was immediately reminded of the last time she saw a closed type of health kiosk. I demo’d HealthSpot Station at the CES preview in NYC in late 2012. It officially debuted at CES 2013. Despite decent takeup, HealthSpot was defunct by mid-2016 having placed only 50 or so stations and burned through a substantial $43 million through its entire short but showy life. Its remains went to now-bankrupt Rite Aid which did nothing reportable with it. HealthSpot had key differences with Forward’s CarePods in that HealthSpot was a place to sit down and have a synchronous virtual visit with a doctor (supplied by Teladoc initially), with vital signs monitoring through self-serve tools in the kiosk. Payment was per use and for the doctor visit. Their problems were placement of rather large units, maintenance, and the general reluctance of people to use monitoring tools at that time within a closed area. Based on the available media, the CarePod technology is much more advanced towards a virtual visit with touch screens, AI assists, sophisticated monitors, and an integrated app that generates care plans. It also builds on an established app and in-office technology. Concerns remain in this Editor’s view about maintenance, especially with the CarePod using much more sophisticated technology, cleanliness, and claustrophobia. FierceHealthcare, PYMNTS

This Editor has also taken a dim view of open kiosks placed in retailers such as CVS Health, Walmart, and supermarkets, such as Higi (bought by Babylon Health but evidently not part of the bankruptcy) and Pursuant Health (the former SoloHealth), having seen all too many of them in dusty corners, neglected, and often with Out Of Order signs. The Forward plan to restrict them to malls, offices, and gyms seems to avoid the retail crunch but one wonders what the breakeven is–or if this is a substitute for office expansion.

A commenter with a far dimmer view than this Editor’s is quoted at length in today’s HISTalk. “The target audience seems to be young, worried well people who prefer faceless machines and tons of prevention-focused data or congratulatory test results to interacting with a clinician. That actually is a pretty good business model. Reviews for the company’s in-person clinics are almost all from customers in their 20s and early 30s.” But the commenter–a customer–is dissatisfied with being completely unable to get someone on the phone, everything done through chat, and wait times to see a real doctor upwards of two weeks.

Most Recent Comments